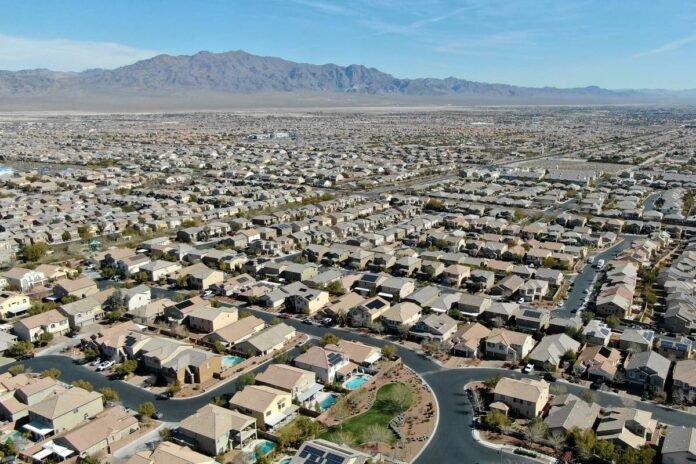

Driven by cheap money, the housing market in southern Nevada has accelerated for months, with record high prices and rapid sales.

And according to a new report, prices here are increasingly – and clearly – overvalued.

Fitch Ratings, in a report Tuesday, estimated that Las Vegas home prices were 30 to 34 percent overvalued in the first quarter, highest among the 50 most populous metropolitan areas in the country.

Las Vegas’ overvaluation range rose from 25 percent to 29 percent in the fourth quarter of last year when it also topped the country, Fitch previously reported.

US house prices have risen at a record pace due to limited supply of real estate for sale, increased construction costs, and strong demand from low mortgage rates and “permanent remote working opportunities,” the credit rating firm said this week’s report.

Fitch also said the factors behind “rapid growth” over the past 12 to 18 months “are not seen as fundamental to sustainable values” and that potentially higher interest rates and higher inventories “could put the damper on future house price growth” . ”

Rising prices, high unemployment

Property prices in Las Vegas have soared over the past year, despite massive job losses from the coronavirus pandemic that has devastated the tourism industry, the backbone of the casino-heavy economy in southern Nevada.

The valley’s unemployment rate has fallen dramatically since the early chaos of the public health crisis, and tourists are flocking back to America’s casino capital. But Las Vegas’ still high unemployment rate remains among the highest in the nation, while the lowest mortgage rates have fueled home purchases by allowing people to break their budgets.

Home hunters have showered properties with offers and routinely paid more than the asking price, and resale prices are reaching all-time highs virtually every month. Home builders, meanwhile, have regularly raised prices, placed buyers on waiting lists and accepted bids for lots, multiple sources say.

The median sales price of previously owned single-family homes – most of the market – hit a record $ 395,000 last month, up $ 10,000 from the previous all-time high in May, the Las Vegas Realtors trade association reported.

The average sales price for newly built homes in southern Nevada was a record $ 402,990 in May, according to Home Builders Research in Las Vegas.

Meanwhile, Las Vegas’s unemployment rate was 8.9 percent in May, the second highest nationwide among major metropolitan areas, federal data shows.

‘Value is relative’

Fitch told the Review Journal that it uses an internal model to calculate a “sustainable” home price – the price level that “fundamentals” can support – and that it believes they are overvalued when current prices are higher.

Several factors are considered as part of the analysis, including unemployment, rent and income.

Rents have also accelerated in Las Vegas. According to listing site Zillow, the typical rental price for a Las Vegas home rose more than 17 percent year-over-year in May, one of the largest increases in the country.

All in all, supply and demand affect house prices, but general economic problems “don’t necessarily catch up that quickly,” said Kevin Kendra, general manager at Fitch, in an interview.

Brian Gordon, a director of Applied Analysis consulting firm in Las Vegas, said the pace of property price growth in southern Nevada is “clearly” unsustainable, but the “question of value is relative.”

Demand for homes remains strong and, according to Gordon, is being driven by low inventory levels, cheap borrowing costs, and a continued influx of new residents, particularly from California.

At the local and national levels, the market showed some signs of cooling during the normally busy spring buying season. But Las Vegas real estate prices are still hitting record highs, homes are selling fast, and buyers reversed a recent drop in sales last month.

The housing market in southern Nevada imploded more than a decade ago after soaring prices and construction. But just because property values are accelerating now doesn’t mean they’re collapsing again, Gordon said.

The doomed boom some 15 years ago was fueled by easy money as virtually anyone could get a mortgage. Las Vegas builders built far more homes than they do now, builders imagined a forest of skyscrapers down the valley, and flipping homes was an easy moneymaker.

Inventory is low in Las Vegas today, but as Gordon noted, that “wasn’t the case” in the mid-2000s.

Supply and demand “are very different now than they were ten years ago,” he said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.