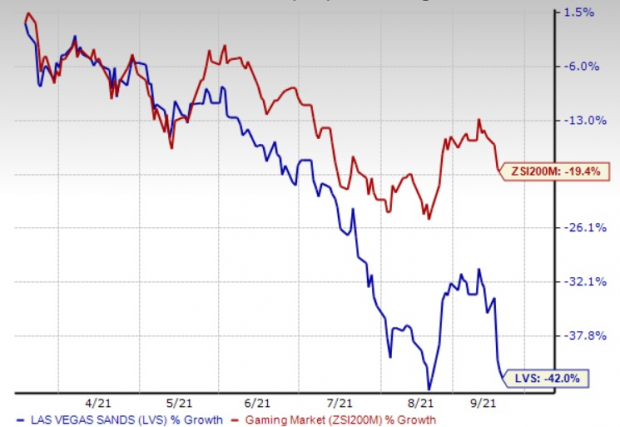

Still hold shares of Las Vegas Sands Corp. (LVS quick offerME AGAINST – Free Report) and waiting for a miracle to bring the stock higher in the short term? If so, you could be losing more money as the chances are very slim that the stock, which has depreciated 42% in value over the past six months, will turn around in the near future. At the same time, the Zacks gaming industry was down 19.4%. Let’s dig deeper and analyze the factors that hurt this 4th (Sell) Zacks company.

Main concern

The gaming industry has been struggling with traffic and sales problems due to the coronavirus pandemic for almost two years. Although casinos in Macau and Las Vegas are now open, visitor numbers are still very low compared to pre-pandemic levels. Meanwhile, the number of visits to Singapore is unlikely to increase rapidly as air travel issues are likely to take time to resolve. The delta variant of the corona virus also remains a problem for the industry. As a result, the recovery in Macau and Singapore remains slow and it is not yet clear when the market will return to pre-pandemic levels.

The company’s quarterly results have further increased investor concern. It reported poor results for the second quarter of 2021, with both earnings and sales missing the Zacks consensus estimate. Although sales and earnings improved year-on-year, it is still well below pre-pandemic levels. In the second quarter of 2021, the company reported an adjusted loss per share of 26 cents, more than the Zacks consensus estimate of 19 cents.

Las Vegas Sands’ problems have worsened due to a new wave of coronavirus cases and news that China is considering tougher casino rules in Macau. According to a DDDreport by macaubusiness.com, the public consultation for a new gambling law runs from September 15 to October 29. The general public will have five meetings while members of the sector will have one meeting. Topics such as the number and duration of casino licenses and supervisory duties are discussed. It is worth mentioning that the current licenses will expire in June 2022.

The revised Gambling Act proposes the abolition of the current sub-concession system. Other proposals include the selection of government officials to oversee gambling operators and the creation of a new illegal deposit crime. Gambling in particular generates nearly 80% of the Macau government’s revenue and accounts for 55.5% of GDP.

China’s health officials announced that new infections with COVID-19 have more than doubled in southeast Fujian Province. Officials are enforcing measures such as travel restrictions to contain the spread of the virus. We believe that Macau’s stricter casino rules and coronavirus issues will continue to harm the company.

Image source: Zacks Investment Research

Growth forecasts

The bottom line of the Zacks Consensus Estimate for 2021 has expanded from a loss of 12 cents in the past 60 days to a loss of 75 cents. The consensus mark for 2022 earnings is down 16.3% over the past 60 days to $ 1.85 per share.

3 tips not to be missed

Boyd Gaming Corporation (BYD-Quick quoteWORLD – Free Report) has a projected long-term earnings growth rate of 40.8% and a Zacks ranked # 1 (Strong Buy). You can see the full list of today’s Zacks # 1 Rank stocks here.

Golden Entertainment, Inc. (GDEN Quick QuoteGDEN – Free Report) has a # 1 Zacks ranking and a projected earnings growth rate of 226.4% for 2021.

Monarch Casino & Resort, Inc. (MCRI quick quoteMCRI – Free Report) has a Zacks rank of # 2 (Buy). The bottom line has surpassed the Zacks Consensus Estimate for each of the past four quarters, with the average surprise averaging 53.3%.